Tax season doesn’t start with filing – it starts with preparation. Taking a little time now to gather information and understand key deadlines can make the months ahead far smoother, especially as returns grow more complex and timelines vary. Whether your return is straightforward or more complex, early organization puts you in a better position to file accurately and with less stress.

Read MoreViewPoints

The United States endured a gritty 4th quarter. AI bubble concerns remained a focal point, policy uncertainty drove renewed interest in gold, the labor market continued to cool, and expectations for interest rate cuts intensified.

Read MoreAs 2026 approaches, it is time to reflect on this past year and prepare for the new year. There is much to reflect on for 2025, but AI stole much of the show. Artificial Intelligence is still dominating headlines and is quickly reshaping our everyday lives. It is imperative we are all aware of its impacts.

Read MoreOutright cash gifts to qualified organizations are among the easiest and most effective ways to support nonprofits. These donations - especially when unrestricted - allow organizations to respond quickly to urgent needs. For example, food banks often partner with local suppliers to purchase pantry staples at steep discounts, meaning your cash donation can go much further than a bag of groceries.

Read MoreConsequently, the impact of the government shutdown will permeate every corner of the country and will affect the Federal Reserve (FED) and financial markets’ visibility of the state of our economy moving forward. In fact, Goldman Sachs estimates that this government shutdown will reduce annualized quarterly GDP by 0.2% for each week the shutdown lingers.

Read MoreYear-round tax planning has become the norm for tax professionals and proactive advice is critical during times of change. The primary goal of tax planning is to maximize after-tax wealth while also achieving non-tax goals.

Read MoreWhether you're navigating retirement or running a business, the OBBBA introduces new twists to two key tax provisions. Learn more about the SALT cap and senior deduction updates, stipulations, and technical aspects so you can make smarter financial moves in 2025 and beyond.

Read MoreThough their situations and relationships are unique, one of the most significant transitions for all occurs when the first spouse dies. Everyone is at a different stage of preparation when this happens, so we do our best to help our surviving spouse clients through the next steps of life.

Read MoreThe U.S. economy is walking a narrow ridge: slowing, but not stalling – disinflationary, but not deflationary. Navigating the path forward through domestic policy changes and global tensions demands agility and discipline to succeed.

Read MoreLosing a loved one is an incredibly difficult experience. During the grieving process, it can be challenging to know what steps to take regarding their important documents. While it may be overwhelming to think about, knowing best practices for storing and keeping documents proactively can help ensure that you have access to valuable information when you need it and help make the process of settling their estate much smoother.

Read MoreLegacy is more than what you leave behind — it is the foundation you build today to empower the generations that follow. Planning for the next generation requires a big picture approach that adopts traditional tools - like trust and tax services - with newer modern innovations - like financial planning and artificial intelligence (AI).

Read MoreThe Federal Reserve held interest rates at the 4.25-4.5% mark for the third meeting in a row, much to the Administration’s dismay. FED chair Jerome Powell is taking a wait-and-see approach with the impact on the newly introduced tariffs.

Read MoreTurbulence is an apt term to describe this year’s political and economic climate thus far. With mounting pressure in the Russia-Ukraine war, the ‘Liberation Day’ trade war, and overall inflation issues, Americans have a lot (and a little) on their plates.

Read MoreOnto the omnipresent topic of the year so far. No, not the daily political headlines, I’m talking about AI. Given that AI needs data to function, you may assume that simply providing that data to the program can produce a reliable plan for any situation. Think again…

Read MoreFrom the sunsetting provisions of the Tax Cuts and Jobs Act (TCJA) to the implementation of SECURE Act 2.0 and new IRS regulations; some notable policy changes will occur at the end of 2025, affecting individuals and businesses alike. Here’s what may impact your finances in the coming years.

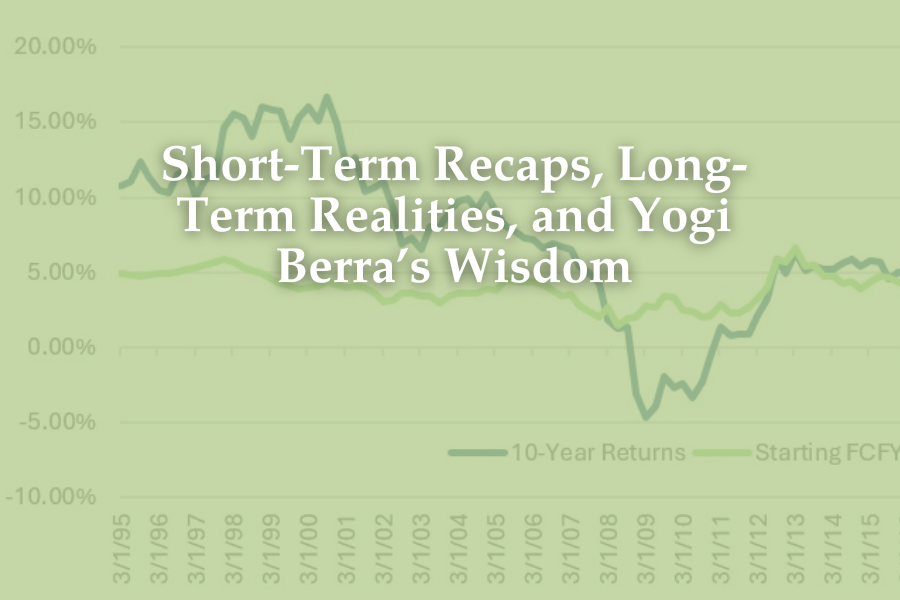

Read MoreYogi Berra was spot on when he said, “It's tough to make predictions, especially about the future.” This quote from Yogi applies each year to capital market participants who love to predict what the economy will do and how much stocks are going to change that year. When assessing the predictions at year end, we find all, or almost all predictions, are proven inaccurate.

Read MoreAt Allen Trust Company, our role is to guide you through the opportunities and challenges that lie ahead, ensuring your wealth aligns with your personal goals and legacy plans. The outlook for 2025 reflects a world in transition, with economic shifts, evolving family needs, and a growing emphasis on sustainability and security. Let me share how these trends could shape our approach to protecting and growing your wealth while preserving what matters most to you.

Read MoreEvery quarter is full of news about the labor markets, inflation, consumer and business spending, corporate earnings accompanied by unanticipated events. Each of these could potentially move the markets. Yet in some quarters, the news and events have negligible effect, and the quarters feel boring. The third quarter of 2024 was not a boring quarter, and more things happened in those three months than what has occurred in some years.

Read MoreIn today's interconnected world, cybersecurity has become necessary to combat potential cyber-attacks on individuals, large corporations, and everyone in between. With more personal, financial, and professional data being stored online – from banking and shopping to managing confidential information – the risk of cyber threats continues to grow.

Read MoreAs we move towards the last quarter of 2024, the efficiency and flexibility of cash gifts may also appeal to you as you contemplate year-end giving. Here are some thoughts on the current available options. In 2024, individuals can give up to $18,000 per individual gift recipient without creating any gift tax liability. If you’re married, that means each spouse can give up to $18,000 per recipient.

Read More