Blockchain’s Rise Should Benefit Select Tech Names

Blockchain is Key to A Long-Term Investment View on Tech

Bitcoin, cryptocurrencies and initial coin offerings have entrenched themselves as front and center topics that are reaching an ever broader audience as new highs in cryptocurrency values are breached. Of these three topics, the long-term implications of blockchain, the technology used by cyrptocurrencies, is the most relevant issue to consider relative to Tech investments. Specifically, we view blockchain as a “foundational”[1] technology, which over time, appears poised to transform the enterprise and consumer technology experience. As such, we are focused on the opportunities and risks presented by blockchain.

Frenzied Moves in Crypto Assets, Risk Factors Remain Elevated

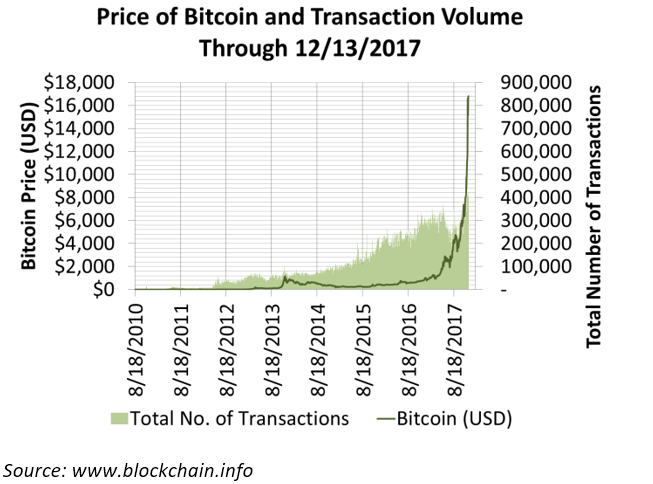

We acknowledge that the recent moves in cryptocurrency asset prices are attention grabbing and headline worthy. The compression of time it has taken Bitcoin to reach new highs is nothing short of dizzying.

Consider that Bitcoin’s rise alone has accelerated from months to minutes. One popular blog notes that the move from $10,000 to $12,000 was accomplished over a 7 day span, while the move from $12,000 to $17,000 was accomplished within a 24 hour window, with the most recent move from $17,000 to $18,000 breached in a matter of minutes.

Recently, SEC Chairman Jay Clayton captured the current mood around crypto assets most succinctly in stating that “There are tales of fortunes made and dreamed to be made. We are hearing the familiar refrain, ‘this time is different’.”

As things currently stand, we take heed of the SEC’s public statement. Specifically, we see cryptocurrencies as high-risk trading instruments. Similarly, direct investments in publicly traded cryptocurrency and related blockchain technology companies is limited and primarily comprised of small- and micro-capitalization stocks.

Crypto Assets in Perspective, Adoption is Key for the Relevance of Cybercurrencies

According to CoinMarketCap, there are currently more than 1,300 cryptocurrencies and tokens with a total market capitalization of nearly $500 billion. Bitcoin has the largest market capitalization of $289 billion, and 22 others having market capitalizations of $1 billion or more. Average daily trading volume on major Bitcoin exchanges alone is now in the $1-$2 billion range, compared to $39 million at the end of 2016. While impressive numbers, we note that the relative market value of crypto assets and daily trading volume remain a small fraction of the total markets found in global bonds, equities and gold – all measured in trillions of dollars.

From a utilization perspective, we note that the penetration of cryptocurrencies for the purchase of goods and services also remains very low. Consider that global purchase volume on credit and debit cards topped $20 trillion in 2016, while global cash and check payment volume is sized at $17 trillion. In our view, it is the utility of cryptocurrencies at the point-of-sale (online and brick and mortar stores) that will determine the long-term viability of cryptocurrencies as an alternative form of payment. Accordingly, acceptance by merchants has to increase and adoption by consumers as a viable alternative to cards, cash and checks needs to take hold. This is a classic challenge faced by all new payment schemes, and one which is further compounded by the current volatility of cryptocurrencies and the early nature of offerings.

Shifting to Blockchain and Its Impact to the Broader Tech Investment Landscape

As we stated earlier, we believe that a more relevant investment discussion should focus on the possible long-term impact that blockchain could have across the broader Tech landscape. In particular, what does blockchain mean for leading Tech companies? Before diving in to this discussion, let’s step back and address the basics of blockchain.

What is Blockchain?

Most experts define blockchain as an open, distributed digital ledger that records transactions efficiently on a peer-to-peer network in a secured, verifiable and permanent way. One useful description provided by Goldman Sachs Equity Research describes blockchain “As a new type of open and distributed database. This database of transactions is split into blocks which are validated by the entire network via encrypted signature verification, and added to the chain of prior transactions.”[2]

As described by Iansiti and Lakhani in their HBR article, there are five basic principles underlying blockchain technology including:

1) A distributed database: Each party on a blockchain has access to the entire database and its complete history.

2) Peer-to-peer transmission: No central node or intermediary exists.

3) Transparency with pseudonymity: Every transaction is visible. Each node, or user, has a unique 30-plus-character alphanumeric ID. However, users can choose to remain anonymous. Transactions occur between blockchain addresses.

4) Irreversibility of records: Once a transaction is entered in the database and the accounts are updated, the records cannot be altered, because they are linked to every transaction record that came before them.

5) Computational logic: Algorithms and rules that automatically trigger transactions.

Why a Foundational Technology Matters

As noted earlier, we agree with the idea that blockchain offers the potential to create new foundations for economic and social systems, expected at both the enterprise and consumer levels.

Taking this view supports two important considerations for Tech investments. First, the adoption of blockchain will be a long-term process, likely measured in decades. Consider the useful comparison to the introduction of TCP/IP, the communication protocol which laid the foundation for the development of the Internet, but took over 30 years to truly deliver on its capabilities and use cases. Second, considering the timeframe for adoption, we see few near-term risks to Tech providers from blockchain. Currently, blockchain appears to offer incremental demand opportunities as large corporations increase their adoption of the technology. Consider disclosed blockchain efforts for select Tech companies aimed at capturing new demand:

Blockchain’s Rise Should Benefit Tech

By most accounts, the direct benefits of blockchain technology will take several years to materialize. As things currently stand, we see future opportunity for a broad swath of Tech names. As for crypto assets, we remain mesmerized by its ascent, but guarded as an investment vehicle given high risk, volatility and limited regulatory construct. Regardless, as the first broad solution built on blockchain we will stay tuned to developments around crypto assets.

[1] Goldman Sachs Equity Research, Profiles in Innovation: Blockchain, May 24, 2016.

[2] Harvard Business Review (HBR), The Truth About Blockchain, Marco Iansiti and Karim R. Lahani, January-February, 2017