Social Security Trustees Annual Report: Tempest in a Teacup?

The 2018 Social Security Trustees Annual Report was recently released and the news media outlets have been in overdrive reporting on the findings. Some news reports claim that the report is alarming, while others state that nothing much has changed since last year.

The numbers show that the Social Security system’s costs will exceed its income this year. This is the first time that has happened since 1982. However, the report also shows that the trust fund will remain solvent until 2034.

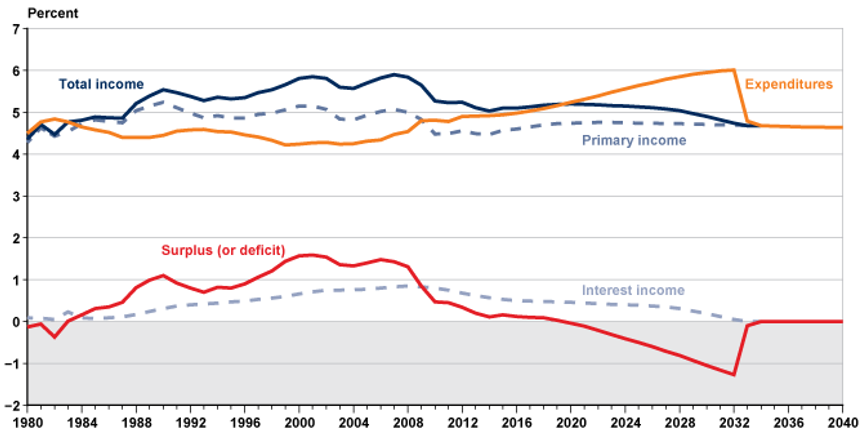

“Chart 1 shows trust fund total income exceeding trust fund expenditures from 1984 through 2019, generating annual surpluses. Beginning in 2020, total income is projected to be less than expenditures, generating annual deficits (shown as negative surpluses).”[1]

But, what happens in 2034? If nothing is done to change the shortfall between expenses and income, beneficiaries will see their scheduled benefits reduce by 23 percent. To illustrate this point, a beneficiary who expects to receive $3,000 per month in benefits will collect $2,250.

And then what happens? If Congress chooses to do nothing, benefits will continue to be paid out until 2092. At that point the Social Security trust will be fully depleted.

Is this new information? No, the Trustees Annual Report has reported similar figures for the last seven years. Between last year and this year, the difference in shortfall is just one basis point. However, the need for action has become more pressing. For each year that the benefits exceed income, the OASDI reserves are reduced, thereby creating less interest income. In addition, each year more baby boomers enter retirement with fewer young people entering the workforce. This leads to the necessity of fewer revenue producers being taxed at a higher rate to offset the increased baby boomer benefit draw.

What can be done? In 1983, the last time the Social Security costs outstripped income, a bi-partisan bill was passed to increase retirement age to 67 and to advance the timeline for increased payroll taxes. There are several potential reforms that are being considered by Congress. They include increasing payroll taxes by 2.78 percent, reducing benefits for all beneficiaries (current and future) by 17 percent, reducing benefits by 21 percent to new beneficiaries only or a combination of all three. Another option being considered is eliminating or increasing the tax cap on income subject to Social Security taxes.

What can you do? Preparing a solid retirement plan that provides income streams other than Social Security will help offset the risk of your benefits being reduced.

Allen Capital Management/Allen Trust Company can help you with questions regarding retirement planning. If you are one of our clients, or would like to be, please contact us at (503) 292-1041 or via email at allison@allentrust.com.

[1] https://www.ssa.gov/policy/docs/ssb/v75n1/v75n1p1.html