What to do with my low basis stock?

Let’s say you bought Apple stock in 1984 for $.50 per share. Congratulations! That stock is currently worth over 400 times that. But now you’re worried that too much of your net worth is tied up in one investment. It’s time to diversify, but that large capital gain also means a large tax bill if you sell it outright. So what are your options?

1. Sell it now

No fancy tax avoidance scheme? Simply selling it and paying the tax? Where’s the fun in that? There would be a tax bill – up to 23.8% in federal capital gains tax, plus the Oregon tax rate maxes out at 9.9%. As much as a third of your gain would be gone, but there are no restrictions on the remaining cash. You can start diversifying right away.

2. Give it away

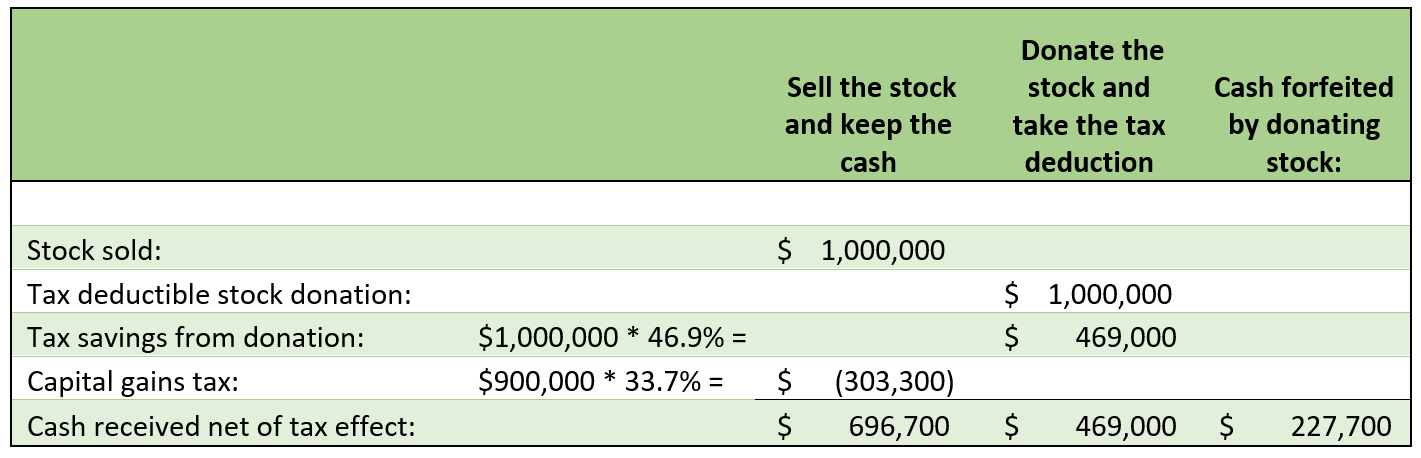

By donating the stock directly to charity, you completely avoid the capital gains tax and get a tax deduction for the fair market value of the stock.This option can benefit the donor more than one would expect.Here is a scenario where a taxpayer owns stock worth $1,000,000 with a basis of $100,000 and is in the highest tax brackets (37% federal ordinary income tax, 23.8% federal capital gains tax, and 9.9% Oregon income tax):

By making this contribution, the taxpayer has a net cash outflow of only $227,700. Not a bad result for a $1million donation, but this assumes the highest tax brackets and that the donation will be fully deductible. Everyone’s scenario is different. Be sure to consult a tax professional to determine how donating stock will affect you.

For large donations such as this, consider contributing to a donor advised fund, where the taxpayer gets a tax deduction right away, and the funds can be distributed to charity in the future. This way, contributions can still be made periodically to your favorite charity and in the meantime, the funds can grow tax free.

3. Diversify through an Exchange Fund.

Also known as “swap funds,” these vehicles provide immediate diversification by allowing owners of a large amount of a single stock to pool together with other investors looking to do the same. Each investor in an exchange fund receives a percentage ownership of all the investments in the fund based on the value of the asset they contributed. Since stock is not sold in the transaction, no capital gains are realized, allowing taxes to be deferred.

Exchange funds are not widely offered, and typically require a minimum investment of $5 million and a “lock-up period” of 7 years or more. They also have high management fees compared to other investments. Exchange funds are not for everyone, but they provide an option for those looking to diversify an investment while deferring capital gains tax.

4. Defer taxes by investing the gain in an Opportunity Fund.

The Tax Cuts and Jobs Act created a new tax incentive for investing in qualified business property in Opportunity Zones, which include economically distressed areas as designated by each state. Tax on capital gains can be deferred until 2026 and have their tax rate reduced by up to 15% by rolling them into an Opportunity Fund. Additionally, the growth of the Opportunity Fund investment also becomes nontaxable if it is realized after being held for ten years or more. These vehicles don’t provide immediate asset diversification, but they provide a tax benefit especially for those looking to reinvest their capital gains in their community.

We are happy to provide more information regarding Donor Advised Funds, Exchange Funds, and Opportunity Funds.Stephen Paul is here for your tax planning needs.Give him a call anytime.We are here to help.