Q4 Commentary: Navigating Market Crosscurrents

The United States endured a gritty 4th quarter. AI bubble concerns remained a focal point, policy uncertainty drove renewed interest in gold, the labor market continued to cool, and expectations for interest rate cuts intensified.

Bubble Déjà Vu?

The biggest hot-topic issue in recent news has been the fears over an AI bubble. In the early 2000s, markets crashed during the dotcom bubble. Valuations were justified by narratives instead of cash flow, as people knew the internet would fundamentally change commerce, communication, and media. Though that part was true, many firms could not convert this newfound growth into profits, and some big failures shattered investor confidence. People are fearful of a repeat of this exact dotcom bubble situation with AI.

Artificial Intelligence is poised to transform our day-to-day lives. The dilemma is not AI’s potential and adoption; it is the pricing. Investors’ fears were heavily reflected in Nvidia’s last earnings report. Nvidia’s earnings topped expectations overall, but the stock price ended 3% lower on the following day. Another example of this fear is showcased with the Oracle earnings call. Oracle’s stock declined more than 10% following their earnings release due to concerns around massive AI spending plans.

Gold’s Role in Uncertainty

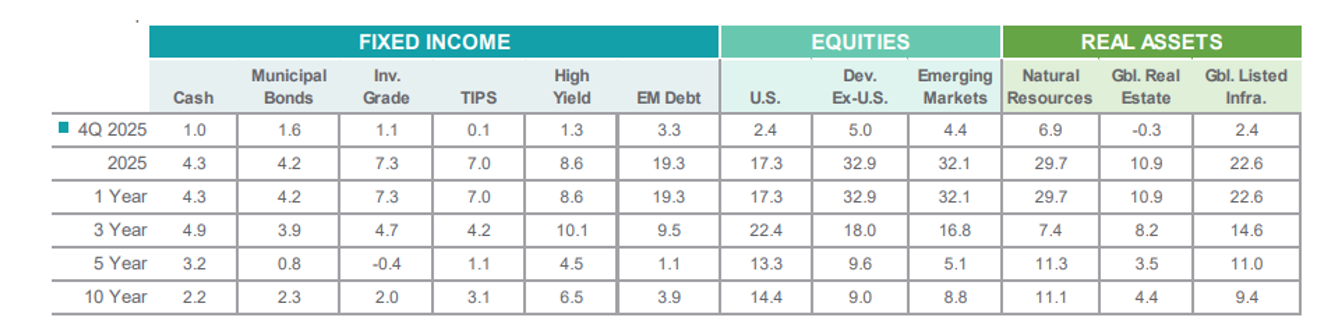

In 2025, the S&P started off rocky, but picked up speed, reaching all-time highs. Interestingly, international and emerging markets stocks outperformed American stocks. The USA bond market also had a great year amid geopolitical uncertainty. This trend aligns with typical investment behavior: in times of long-term uncertainty, the safest place for money is bonds

Source: Northern Trust

With respect to reliability, investors flocked to commodities that offer security. The price of gold soared in Q4, reaching an all-time high of around $4,550 per troy ounce on December 26. In times of macroeconomic and geopolitical uncertainty, gold is typically viewed as a hedge against inflation. Gold preserves its value due to its finite amounts and unique attributes. Investors fled to gold in 2025, leading to all-time-high prices. In fact, natural resources were the highest earner for investors in Q4 2025 at 6.9%, with developed nations coming in second at 5% (see chart above).

Labor Market Loses Steam

Though the market remained robust in Q4, the job market continues to cool. We lost 67k jobs in Q4. In fact, job openings per unemployed person reached below parity at 0.91 – about 91 job openings per 100 job seekers – which marks the lowest value since March 2021. The current labor market is demand-constrained, with the Leisure & Hospitality industries leading in the decline.

A slowing job market normally signals slowing inflation. In 2025, the Consumer Price Index (CPI) increased 2.7%, slowing modestly from 2024’s 2.9% increase. Gasoline prices declined 3.4% in 2025, the largest percentage drop for consumers on the year. Energy services led the CPI increase, rising 10.8% on the year.

Looking Ahead to Potential Rate Relief

Interest rates were the big motif of 2025, as the FED cut interest rates twice this past quarter, from 4-4.25% all the way down to 3.50-3.75%. The FED is deploying expansionary policy to curb the slowing labor market, as inflation is cooling off in the second half of the year.

Overall, 2025 was an eventful year. Looking at headlines, an investor would think that the stock market had its worst year in a long time. Instead, the S&P reached all-time highs during Q4. As for 2026, the AI bubble and interest rates are immediate issues to monitor. The FED pointed out in mid-2025 that their steady-state inflation rate was 2%, so the balancing act between steady inflation and unemployment will be a focal point. Underneath the hood of a year littered with fearful headlines is a lesson: remain focused on the fundamentals of investing, properly analyzing securities with key performance indicators and abiding by the principles of compound growth.

Akili Kelekele is as an Investment Analyst at Allen Trust Company. Akili is a Quantitative Economics graduate from Tufts University. Before joining Allen Trust Company, Akili worked as an Equity Research Associate for D.A. Davidson in New York City.

Disclosure: The information provided in this writing is for general informational purposes only and does not constitute financial advice from Allen Trust Company and Allen Capital Management. Readers are encouraged to consult with a qualified financial advisor to assess their individual circumstances and make informed decisions based on their specific situation.