Tax Provisions under the OBBBA

Whether you're navigating retirement or running a business, the OBBBA introduces new twists to two key tax provisions. Below you will learn more about the SALT cap and senior deduction updates, stipulations, and technical aspects so you can make smarter financial moves in 2025 and beyond.

Setting the Scene

The One Big Beautiful Bill Act (OBBBA) was signed into law on July 4th, 2025. It contains many tax provisions that go into effect in 2025 and beyond. This bill has given tax practitioners some clarity regarding some of the many tax laws that were set to expire at the end of 2025. We now have new information that provides guidance for tax planning moving forward.

Some of the tax provisions are permanent and some are temporary. I’m going to focus on two tax provisions, the state and local tax deduction cap (SALT cap) and the new senior deduction. The SALT cap can provide an increased deduction to taxpayers in high income tax states and high property tax states. The senior deduction can provide an additional deduction to individual taxpayers who are 65 and older. You will learn what the stipulations are and some of the technical aspects behind these two tax provisions.

How Did We Get Here?

Back in 2017 one of the largest tax reform bills was signed into law, known as the Tax Cuts and Jobs Act (TCJA). It included major changes such as doubling the standard deduction, limiting itemized deductions, and increasing the federal estate tax exemption. The increase to the standard deduction led to more tax filers taking the standard deduction as opposed to itemizing. According to data from USAFacts, “the portion of returns claiming the standard deduction grew from 69.4% in 2017 to 90.5% in 2022 after the TCJA” (USAFacts, 2024).

The decision for tax filers to take the standard deduction was easier in recent years but with the new changes in the OBBBA, we might see more tax filers going back to itemizing. Many of the tax provisions in the TCJA were set to expire at the end of 2025, but with the recent passing of the OBBBA it extends many of these expiring provisions while also introducing new ones.

SALT Cap: State and Local Tax Deduction Cap

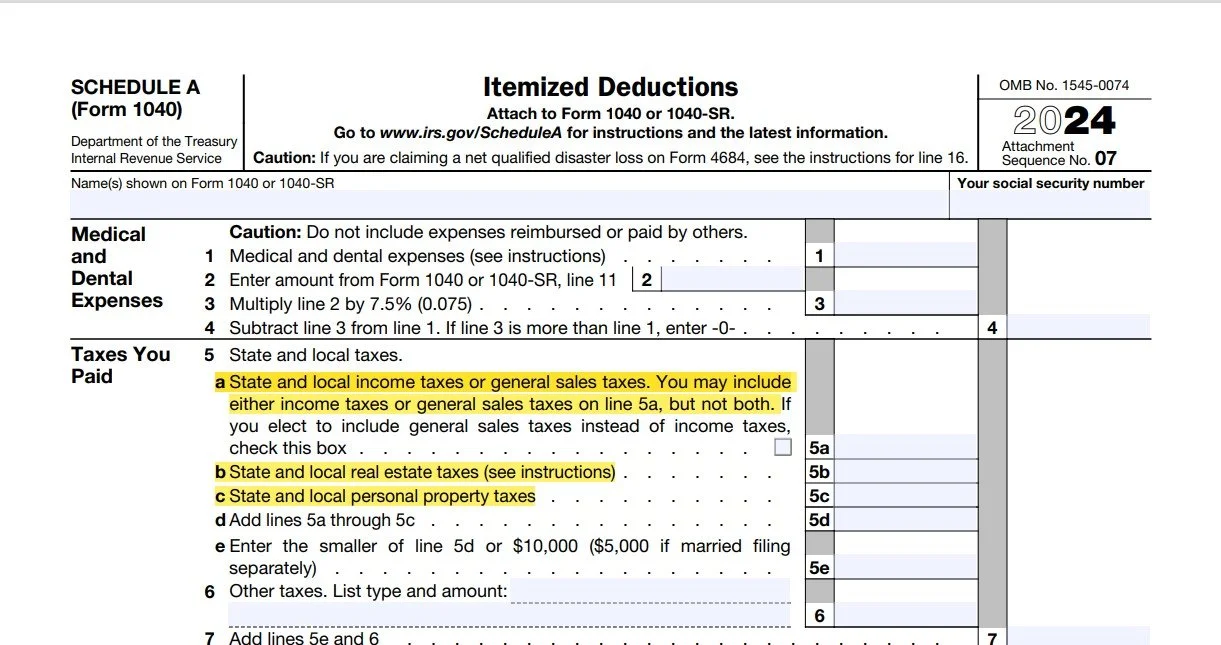

The federal deduction for state and local taxes has been temporarily increased to $40,000 (from $10,000) starting in 2025 and it is set to increase by 1% each year through 2029, with the limit reverting back to $10,000 in 2030. The deduction phases out for both single and married couples earning over $500,000. The state and local taxes deduction offers two* separate options;

1. Elect to deduct state and local general sales tax, or;

2. Deduct local income taxes

*You may also include real estate taxes and personal property taxes. You cannot deduct federal income taxes, social security taxes or federal estate and gift taxes. This tax provision is new for 2025 and provides an increased deduction to the taxpayers that are below the income threshold of $500,000 and choose to itemize.

If You Are 65 and Older

According to the latest IRS fact sheet (edited 25-Jul-2025), The One Big Beautiful Bill Act creates a new additional deduction of $6,000 for individuals aged 65 and older, effective from 2025 through 2028. This deduction is in addition to the current standard deduction for seniors.

For married couples where both spouses qualify, the total deduction can be $12,000. The deduction phases out for taxpayers with modified adjusted gross incomes over $75,000 ($150,000 for joint filers). It is available to both itemizing and non-itemizing taxpayers, provided that taxpayers include the Social Security Number of qualifying individuals on the return and file jointly if married.

For a married couple over the age of 65 earning less than $150,000, their standard deduction in 2025 would be $30,000 plus $1,600 per spouse plus an additional $6,000 per spouse. In this scenario their standard deduction would be $45,200.

Steps You Can Take

Now that the OBBBA has been signed here are some steps you can take now:

Review your tax situation with a tax professional and assess how the changes may affect you.

If eligible, take advantage of the increased deductions to do Roth conversions or other tax strategies.

Explore opportunities to learn about the various provisions included in the new bill.

Disclosure: The information provided in this writing is for general informational purposes only and does not constitute as financial advice from Allen Trust Company and Allen Capital Management. Readers are encouraged to consult with a qualified financial advisor to assess their individual circumstances and make informed decisions based on their specific situation.

References:

USAFacts. (2024, July 1). How has TCJA impacted individual income taxes? https://usafacts.org/articles/how-has-tcja-impacted-individual-income-taxes/

Thomson Reuters. (2025, July 22). How the 'One Big Beautiful Bill' reshapes SALT planning. https://tax.thomsonreuters.com/blog/how-the-one-big-beautiful-bill-reshapes-salt-planning/

Internal Revenue Service. (2025, July 25). One Big Beautiful Bill Act: Tax deductions for working Americans and seniors. One Big Beautiful Bill Act: Tax deductions for working Americans and seniors | Internal Revenue Service

About Schedule A (Form 1040), Itemized Deductions | Internal Revenue Service

Disclosure: The information provided in this writing is for general informational purposes only and does not constitute financial advice from Allen Trust Company and Allen Capital Management. Readers are encouraged to consult with a qualified financial advisor to assess their individual circumstances and make informed decisions based on their specific situation.