Q1 Commentary – Brighter Days Ahead

I always look forward to the changing of the calendar from one quarter to the next. It means we are about to get a flood of corporate earnings reports detailing how corporations performed in the just completed quarter along with an outlook for upcoming quarters. This shows how the economy may perform over the same period. In the light of the corporate reports from around the world, it is time to reassess our outlook for the economy and the markets over both the near- and long-term. This excitement holds particularly true moving from the first quarter into the second as the promise of warmer weather shines a more optimistic light on the released reports. This has, thus far, proven true moving from February to March to April and expectations for the rest of the year are likewise more optimistic. Here we will review the first quarter of 2024 and finish by offering our outlook for the rest of 2024.

A year ago, we along with many others, were expecting a recession would hit economies around the world because of the rapid rise in interest rates. Our outlook was evidently wrong as the economy accelerated to over 3.5% on average in the second half of 2023. The acceleration was due to the strength of the labor markets and the consumer. In the fourth quarter last year, consumer spending accounted for 2.2% of the 3.4% increase in economic growth. This trend continued in the first two months of the quarter as consumers increased their spending by almost 3% from August. Consumer spending is supported by faster job creation, which rose from an average of 212,000 in the fourth quarter of 2023 to 276,000 in the first quarter this year. A leading indicator of job growth is first-time unemployment claims. Here the outlook remains positive with claims still low at approximately 200,000 per week, adding further support to consumer spending growth.

Business spending was also additive to growth with the strength in structures and intellectual property buckets. In the first two month of this year, business spending increased a muted 0.3%. Business spending is typically less than consumer spending and that trend has continued so far this year. The government is even getting into the positive spending program with local, state, and federal spending all adding to economic growth, and since this is an election year, we expect that will continue throughout the year.

The reports noted above show that, at least this year, everything looks better in the spring. But as is often the case in springtime, storm clouds build. Today’s storm clouds are building with the biggest economic headline of the last three years: inflation. Each month of the first quarter inflation has been higher than expected and we have even seen an increase in the year-over-year rise in prices. Inflation increased 0.4% in February and March and, at the end of the first quarter, prices measured by the consumer price index

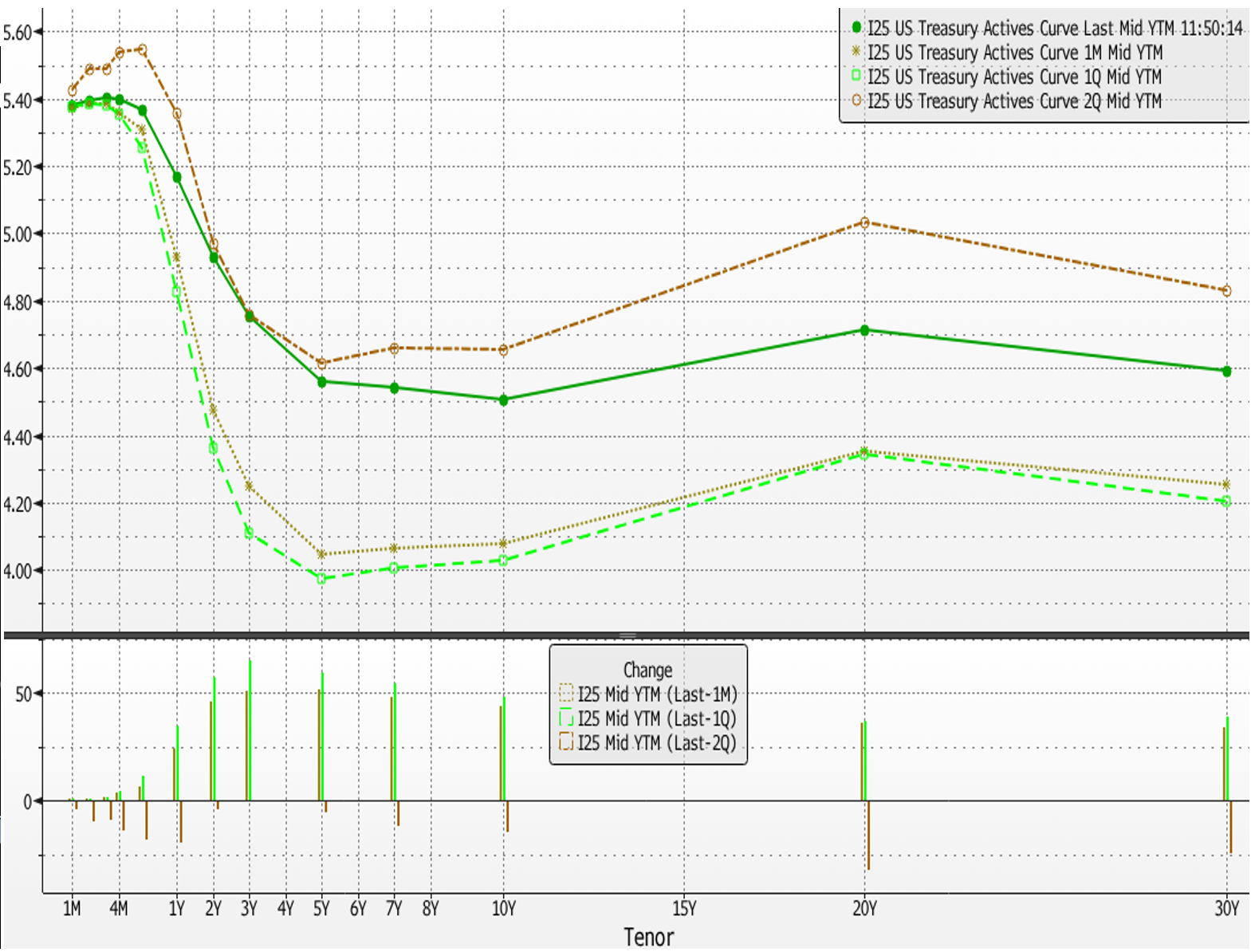

(CPI) have increased 3.5% year-over-year. The unwelcome surprise of a higher CPI sent interest rates higher, and bond and stock prices declined. The war in the middle east is influencing our inflation levels by pushing oil prices higher. Oil prices were the surprise in the inflation report by adding to inflation on a year-over-year basis for the first time in 13 months, in addition to increasing shipping and transportation costs.

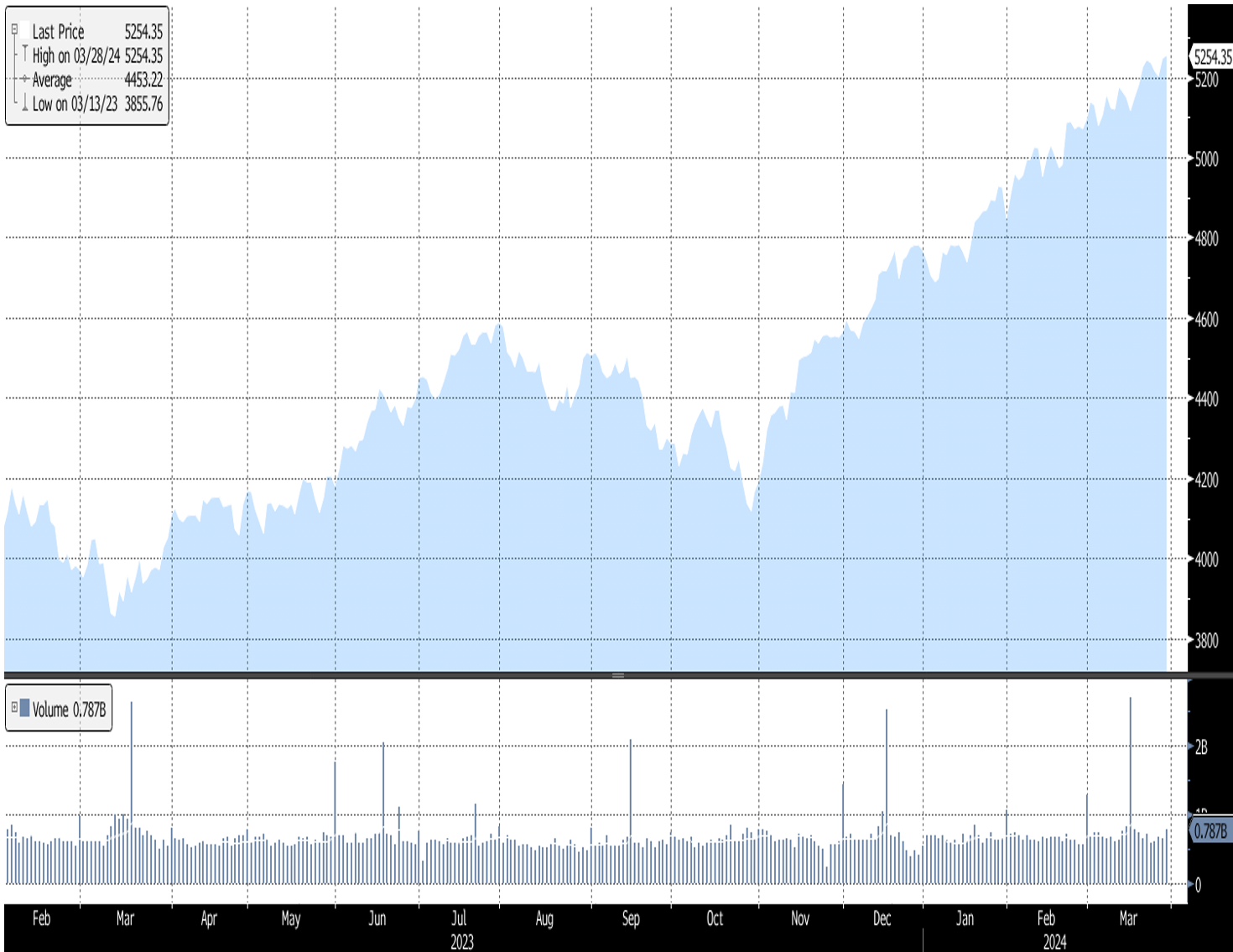

At the beginning of the year, markets were expecting 6 or 7 rate cuts from the Fed while the Fed was saying they would be cautious with rate cuts to ensure that inflation would get down to the 2% comfort level. Despite these differing outlooks, equities jumped 10.5% and Treasury yields were falling. With inflation surprising to the upside in January and February, the statement “Don’t fight the Fed!” came back into vogue, reducing expectations for the number of rate cuts which pushed interest rates higher. The higher rates resulted in a decline of 0.78% in the bond markets in the quarter.

For the quarter, Allen Trust Company clients’ portfolios increased 4.9%, net of fees compared to the 5.5% return of the benchmark.

Despite the recent upside surprises in inflation, we expect inflation will trend lower for the full year. Business and consumer spending growth will be below levels of 2023 but are likely to remain positive, and we favor equities over bonds because we think it is more likely that the Fed will cut fewer than three times this year. Within equities we believe the drivers of performance will migrate from the so-called Magnificent 7 to companies that have not participated to the extent the biggest companies have the last few years. We believe the excess liquidity generated by the super low interest rates will continue to seep out of the market which may delay significant declines in bond yields; but yields should decline a little bit through the end of the year.

Clinton S. McGarvin, CFA, is a Senior Portfolio Manager. Clint is a part of the investment team covering Global Equities, Fixed Income and Real Estate Investment Trusts. He is involved in all aspects of managing client portfolios and has worked in the investment industry for more than 16 years with a strong track record of equity research, portfolio management, and client service. To speak with Clint McGarvin, please contact our office at (503) 292-1041 or via email at info@allentrust.com.